Are You Experienced?

The rally has gone further than we initially thought, however, we still believe the combination of technicals and fundamentals will lead indexes to re-visit their August 5th lows. Let's dig in...

As an introduction to today’s note, we wanted to be explicit about our current view.

As we wrote last week, we believe there is a high likelihood (~80% chance) of a “re-test” of the August 5th low.

What would a “re-test” look like?

The major US equity indices would trade back down to the neighborhood of last Monday’s levels - in some cases a little higher and in other cases possibly a little lower.

Once at those levels - the market could either bounce (a successful “re-test”) or collapse (confirming the possible head and shoulders we highlighted here).

In our view, the odds favor a successful “re-test” (60-70%) rather than a collapse (30-40%).

Finally, as we have been saying for some time (see the introduction here):

While our S&P 500 target is 5500, it is possible in a blow-off top type scenario that the S&P 500 could move to 5600 or even 5800. [The S&P 500 hit 5600].

That said, we are beginning to see possible cracks in the foundation of the market’s ascent that, in our view, could become more apparent either late this year or in early 2025.

Although it’s a fools errand to try to develop a 6, 12 and 18-month road map for the equity market, we see the possibility (10-15% likelihood) of a 30% sell-off that see the S&P 500 bottom around 4000-4200 in 2025 from a peak of 5500-5800 in 2024.

While we continue to see the 10-15% likelihood of a 30% sell-off in the S&P 500, we see the current period as a normal seasonal sell-off.

We think fear of a recession may calm down and this is unlikely the beginning of the 30% sell-off that we have considered.

We have used the current bounce from last Monday’s low to re-load some of the put spreads that we sold into the August 5th sell-off and to heighten the quality of our portfolio.

1. Why We Question the Bounce (Part 1): The S&P 500

Source: Trading View. Through year-to-date 2024.

The chart above shows the S&P 500 ETF (ticker: SPY).

Although we showed this last week (here) and the week before (here), given the sell-off and bounce, we believe it is critical to update this chart in order to articulate our overall market view.

When we wrote about the S&P 500 ETF last week, we identified the 525 level as the key hurdle. We were wrong.

The challenge looks like it is the 541 level (dashed light blue line on the chart) that represents the floor of the June / July rally.

Remember the July portion of the rally was based on the cyclical rotation (away from technology) and represented the expansion of breadth (more companies participating).

With the sell-off, the market essentially erased that.

We believe that the buying power needed to move back above the 541 level will take time build up.

In our view, it is likely that the S&P 500 ETF will revisit the neighborhood of the August 5 low (510-520) before moving meaningfully above the 541 level.

The title of this (and the next two charts) is “Why We Question the Bounce.”

To be clear, what we really question is how far the bounce will go and if it is the foundation for a further move back to the mid-July high.

Very simply, we believe there is more work to do and we do not believe that the August 5th low will represent a “V” bottom.

(This is not a recommendation to buy or sell any security and is not investment advice. Please do your own research and due diligence).

2. Why We Question the Bounce (Part 2): Small Caps

Source: Trading View. Through year-to-date 2024.

The chart above shows the Russell 2000 Small Cap ETF (ticker: IWM).

The Russell 2000 is considered to be the more economically sensitive / domestic-reliant corner of the US equity market.

When Small Caps rallied in July, it was a sign of a soft-landing as well as a cyclical rotation within equity markets.

Unfortunately, similar to the S&P 500, the Small Caps achieved a new higher range in their climb back to their November 2021 high and lost the new higher range in the early August sell-off.

We see the Small Caps as once again “trapped” under $208.50 (maybe $210) and back in their first half of 2024 range ($193 - $208.50).

The good news that Small Caps were able to bounce off of the 200-day moving average. This could continue to provide a floor going forward.

However, we think there is more work to do before once again meaningfully exploring the north side of $208.50.

(Past performance is not indicative of further results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

3. Why We Question the Bounce (Part 3): Earnings

Source: FactSet. Through year-to-date 2024.

The chart above shows the S&P 500 earnings estimates for Q2 2024 through Q2 2025 as of June 14 and August 9.

While 2nd quarter earnings are now coming in 1.3% higher than expectations from when there were two weeks left in the quarter, analysts have lowered expectations for the next three quarters (presumably based on guidance from management teams).

Notably, for Q3 2024 - the quarter for which management teams should have the most visibility (because we are over 1/3 of the way through), earnings estimates have been trimmed by 3%.

We have written several times that in our view earnings estimates for the second half of 2024 were too high.

Although they are coming down, analysts have increased earnings for quarters well into the future. In our view, this helps temper the reduction in next 12 months earnings.

Looking closely, you can see that although earnings for the next three quarters have been reduced, somehow analysts are expecting better earnings for Q2 2025, a quarter into which they have the least visibility of the periods shown.

We have called this game “cut and roll.”

We recognize that this fundamental backdrop has not been a market driver for the past 18 months.

Despite momentum and size being the dominant market factors in the current period, we continue to consider earnings and valuation in our framework.

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

4. All That Glitters: Gold

Source: TradingView. Through year-to-date 2024.

The chart above shows price of Gold ($/oz).

We have drawn in what we believe is a large “cup” (the bigger light blue arc) and “handle” (the smaller light blue arc) technical pattern.

Typically these patterns are symmetric in that the upside target, once the rim of the cup is surpassed, is equal to the distance from the rim of the cup (1900) to the bottom of the cup (1050).

In the chart above, the upside objective is 2750 (1900+(1900-1050)). This would be 12% higher than today’s level.

The challenge is that the “cup and handle” pattern required 12 years to develop and the upside objective is unlikely to be achieved in the very near-term.

However, for those willing to do the work, there appears to be an opportunity in gold mining shares.

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

5. Was that It? Putting 2024 in Perspective

Source: Carson Investment Research / Ryan Detrick. Through year-to-date 2024.

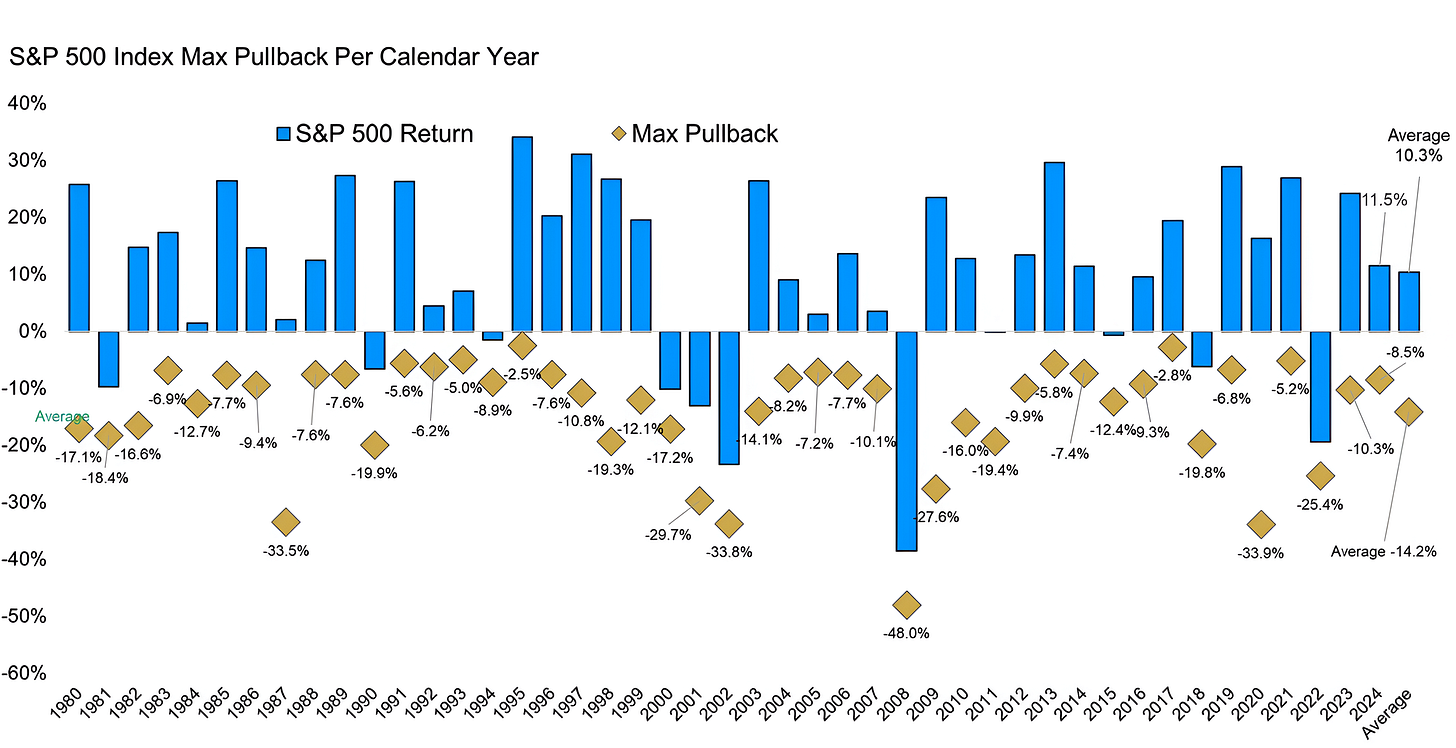

The chart above shows the annual S&P 500 return since 1980 with the each year’s maximum pullback.

While the rest of this note is somewhat cautious - especially with respect to the near-term - we have been careful (in general) to keep an open mind and to highlight the more constructive scenarios.

Since 1980, the average annual return for the S&P 500 has been 10.3% with an average maximum pullback of 14.2%.

Thus far in 2024, the return has been 11.5% with an 8.5% pullback. If the year ended today, we would consider this within the realm of “normal.”

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security, please do your own research).