Good Times, Bad Times

Yesterday, it seemed as if the market was pricing in a Fed easing and a soft landing. Today, it seems as if the market believes the Fed is already late and a recession is coming. Let's dig in...

1. An Update on the Nasdaq 100 “Head and Shoulders”

Source: Trading View. Through year-to-date 2024.

Last week (here) we showed the chart above of the Nasdaq 100 ETF (ticker: QQQ) and remarked, “we see the possibility of a bearish “head and shoulders” formation developing. (The three arcs on the top right of the chart).”

The day after we wrote that, the Nasdaq 100 ETF fell below the neckline. It traded sideways for four days before recovering yesterday.

This morning (the final red bar on the right), the ETF moved back up to the neckline and dropped.

When we wrote about the “head and shoulders” last week, we said, “If the pattern were to fully develop, we would expect a downside target around $449 (highlighted on the chart).”

$449 remains our downside target.

The combination of aggressive earnings expectations, above average valuation, the Fed (who was non-comital yesterday) and the mixed macro-environment (chart 3) continue to make this a complicated investment environment.

(This is not a recommendation to buy or sell any security and is not investment advice. Please do your own research and due diligence).

2. Another Look at the Recent Rotation - Was That It?

Source: Trading View. Through year-to-date 2024.

The chart above shows the S&P 500 relative to the Equal Weight S&P 500.

Yesterday, we showed the Nasdaq 100 relative to the Equal Weight S&P 500.

Before providing our thoughts on the chart, we wanted to highlight why we show these relative charts and what makes them significant.

Essentially, relative charts show the outperformance or underperformance of one asset vs. another.

As investors, we generally have a finite amount of capital and, all else equal (especially risk), we want that capital working for us in the most productive way possible.

As an example, in any given year - 2023 for example - we can assume there are two assets - let’s say one is called the S&P 500 and the other is called the Equal Weight S&P 500.

For the year, one (the S&P 500) was up 24% while the other (the Equal Weight S&P 500) was up 12%, all else equal, we would have wanted to have been invested in the S&P 500. (We showed long-term annual comparative returns in chart 5 here).

When looking at the chart above and considering whether to make a long-term allocation to the Equal Weight S&P 500 over the S&P 500, essentially, one would have to believe that the rotation that began in mid-July and has bounced exactly at the 2020 high of the relationship will fall further.

Given the different sector weightings (less technology in the Equal Weight S&P 500); style differences (more growth / less value in the S&P 500); market cap weight differences (lower average market cap in the Equal Weight S&P 500); valuation difference (S&P 500 is more expensive - see chart 4 here) and factor differences (more momentum in the S&P 500) between the two indexes - allocating to both could provide simple diversification benefits.

That said our preference is to actively manage our exposure to both of these ETFs (there is no reason to remain static) using the charts of both individual indexes as well as the relative relationship as a guide.

(Past performance is not indicative of further results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

3. The Economic Challenge

Source: Haver Analytics, Institute of Supply Management. Through year-to-date 2024.

The chart above shows the Employment subindex from the ISM Manufacturing Survey that was released today. The grey areas on the chart are US recessions.

Yesterday, the Fed said that it was beginning to focus on the second portion of its mandate - employment - and we have noted several times that weak employment is often a recessionary signal.

As can be seen on the chart, the ISM Employment subindex fell from 49.3 to 43.4.

This was the weakest employment reading in the survey since June 2020 and it was actually lower than in September 2008 (45.4) which was when Lehman collapsed and the economy, unbeknownst to practically everyone, was in the 10th month of a recession.

The official non-farms payroll report for July will be released tomorrow.

Ironically, also in today’s ISM Manufacturing report prices-paid (often an inflation indicator) firmed to 52.9 from 52.1.

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

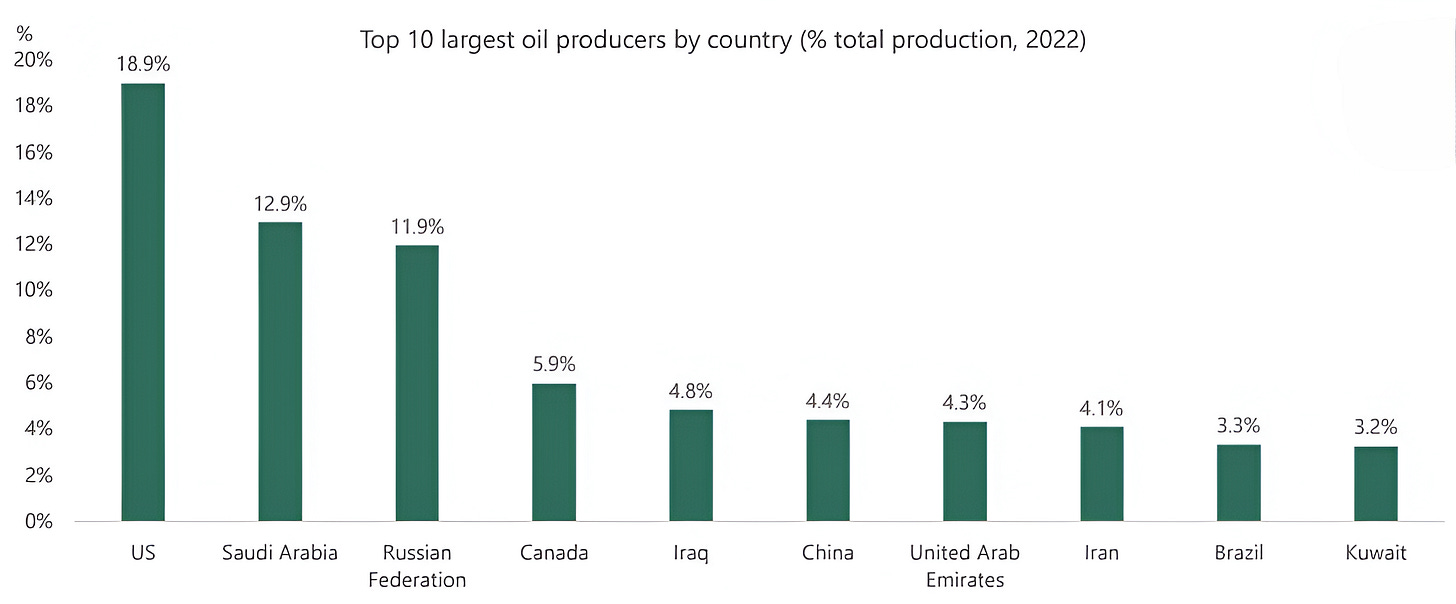

4. Oil Production by Country (2022)

Source: Apollo Chief Economist. 2022.

The chart above shows the % of global oil production produced by the 10 largest oil producing countries.

The US is the largest oil producing country in the world.

I would simply categorize this as “tell me something I didn’t know.”

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

5. Better than Average, but Not Great

Source: Strategas. Through year-to-date 2024.

The chart above shows the average performance of the S&P 500 since 1950 during August and September when the S&P 500 is in a positive trend (the current condition); a negative trend; and in all observations.

Yesterday, we showed the average monthly performance of the S&P 500 for the last 10 years and wrote, “if August and September are consistent with their character from the last 10 years, there may be a challenging two months ahead.”

While the returns in the S&P 500 during August and September when the Index is in a positive trend are not great (average = 0%, median = 0.9%), they are better than when the S&P 500 is in a negative trend.

Regardless, given macro and US Presidential election uncertainty, the current two-month period will likely be more challenging than the first seven months of this year.

In our view, a near-term drawdown could lead to an attractive buying opportunity.

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security, please do your own research).