Winds of Change...

With the Nasdaq 100 and S&P 500 both having hit our target and paused, earnings season and the unusual US Presidential cycle may dictate US equity direction. Let's dig in...

There have been more conspiracy theories over the past two weeks than in any time I can remember.

There are several surrounding the Trump assassination attempt (from the left and right) and this wee,k the fact that Biden has not been seen for some time along with his spontaneous withdrawal from the election on X has led to many “theories.”

With that in mind, we would note that there is a conspiracy theory about the song from today’s title “Winds of Change” by the Scorpions.

Some say the song was written by the CIA and helped bring an end to the cold war. (I didn’t make this up - see here).

1. The Nasdaq 100 Reversed at Our Target. What’s Next?

Source: Trading View. Through year-to-date 2024.

The the chart above shows the Nasdaq 100 ETF (ticker: QQQ).

We showed this chart 3 weeks ago (chart 1 here).

At the time, we wrote:

“The Nasdaq 100 ETF is nearing our target of $496 which is 3.5% higher than last Friday’s closing level.

Similar to our S&P 500 target, our Nasdaq 100 target reflects the 1.618 extension of the November 2021 to October 2022 sell-off.

Could the Nasdaq 100 move a little above our target?

Absolutely, but our expectation is that there will be a pause and at least a minimal retracement from around that zip code.”

This seems to be exactly what has happened.

In that same piece, we questioned whether it made sense for the “hyper-scalers” - Microsoft, Google, Apple, Meta and Amazon to spend $185 billion on AI this year.

Since that time, while continuing to acknowledge the promise of AI, others have begun to question the return on investment.

When we look at the chart above, we see the possibility of a bearish “head and shoulders” formation developing. (The three arcs on the top right of the chart).

The Nasdaq 100 may currently be forming a right “shoulder”.

If the pattern were to fully develop, we would expect a downside target around $449 (highlighted on the chart).

Over the next two weeks, the majority of large cap US companies will report earnings.

In our view, the outlooks that management teams provide about expected earnings and earnings growth will set the tone and direction in the equity market. (See chart 2).

While the technical indicators that we highlighted last week (here) point to further upside, earnings expectations (chart 3), valuation and the macro-environment make this a complicated investment environment.

We have continued to remain invested and have used put and put spreads from time to time to hedge our exposures. We continue to see this as a constructive way to navigate.

(This is not a recommendation to buy or sell any security and is not investment advice. Please do your own research and due diligence).

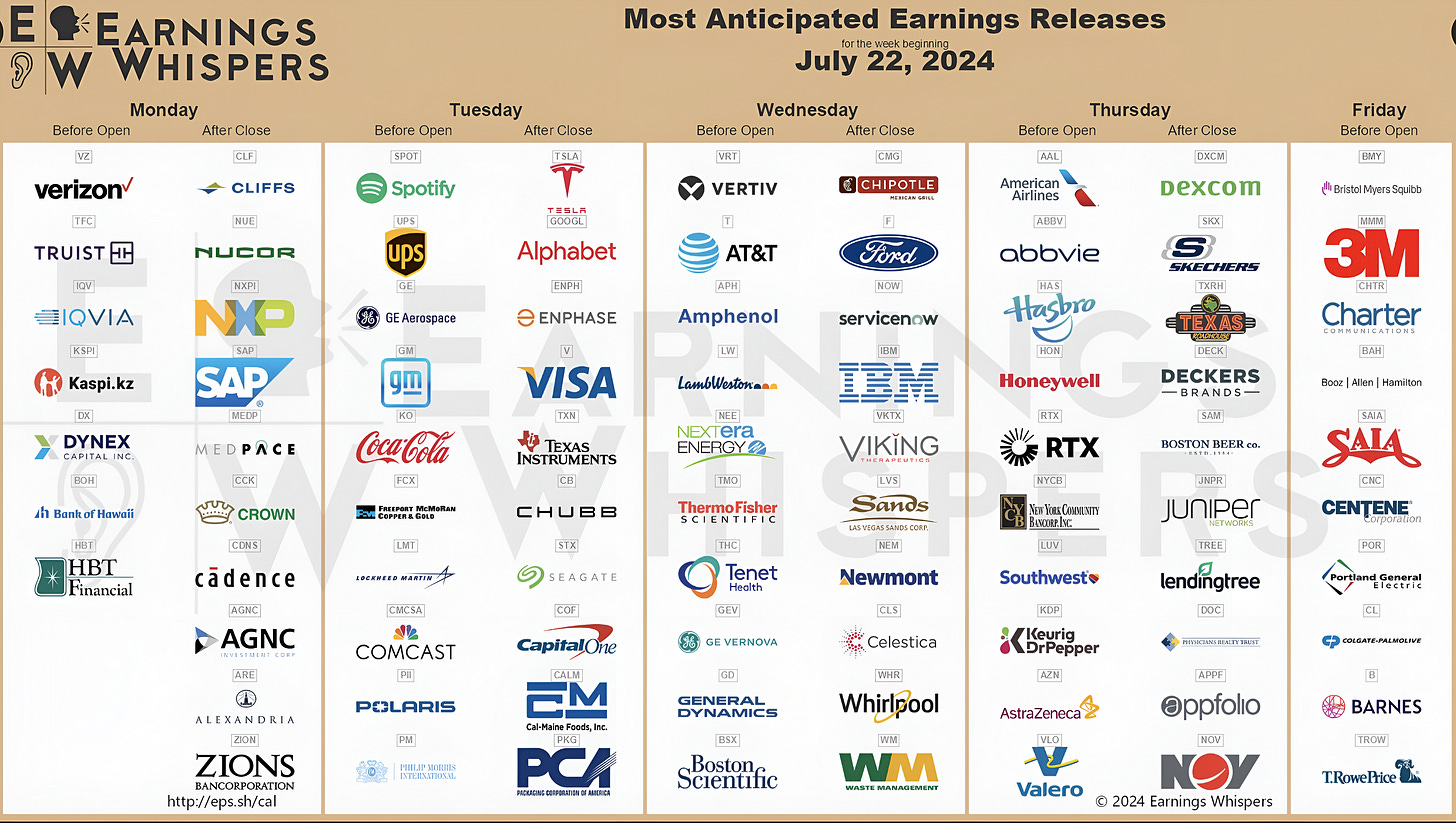

2. A Busy Earnings Week

Source: Earnings Whispers. Through year-to-date 2024.

Over the next two weeks, the majority of the S&P 500 will report earnings.

This week 138 companies will present their second quarter earnings and the graphic above highlights the reporting schedule from some of the larger companies.

While Alphabet reports this afternoon, it was Verizon’s results yesterday that grabbed our attention.

Verizon is the largest US wireless carrier.

In its earnings statement, the company said, "Consumer Wireless equipment revenue was $4.1 billion, down 6.5% year over year, driven primarily by a 14% year over year decline in upgrades."

Why is this important?

Apple reports next week.

Since its developers conference five weeks ago, Apple shares have rallied 14% and have helped support both the S&P 500 and the Nasdaq 100.

The catalyst for Apple shares - an iPhone upgrade cycle driven by AI.

However, looking at the iPhone AI upgrades that were announced at the developers conference, they were underwhelming.

The big announcement was improved Siri. There was also better facial recognition search in the photo app and some new emoji features.

In our view, these upgrades, despite the AI label, seemed evolutionary rather than revolutionary.

Will they drive an upgrade cycle with a challenged consumer?

Although we are not sure, with Apple trading at 35x forward earnings, there is the possibility that the positive news is priced in.

While Apple is not the market driver it once was, it continues to have an impact on market sentiment and direction.

We will continue to dig into all earnings as they are released.

(PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

3. Continuing to Consider Earnings Expectations

Source: FactSet. Through year-to-date 2024.

The chart above shows S&P 500 actual and estimated quarterly earnings growth.

Although at times, we feel old fashioned focusing on (and expressing concern about) earnings and earnings growth, we can’t help ourselves.

One of our core views has been that earnings growth estimates for the second half of 2024 and for full year 2025 are too high. (See chart 2 here and here).

On May 3, the expectation was that Q2 and Q3 2024 S&P 500 earnings growth would be 9.2% and 8.0%, respectively.

Currently, expectations are 8.8% and 6.5%.

In other words, air is slowly leaking from the earnings balloon. But these are not the “big” quarters.

Q4 S&P 500 earnings growth expectations are currently 16.9% while S&P 500 earnings in every quarter of 2025 are expected to grow 14% to 15%.

We simply don’t see this as realistic.

With the S&P 500 trading at 20x 2025 earnings, we see this as a potential risk.

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

4. Healthcare Sector - Is it Just Getting Started?

Source: Trading View. Through year-to-date 2024.

The chart above shows the Healthcare Sector ETF (ticker: XLV).

The largest components in the sector are: Eli Lilly (11%); UnitedHealth (8%); Johnson & Johnson (7%); Merck (6%); and AbbVie (6%).

We see the possibility of the sector being driven higher by diet drugs (Eli Lilly); beauty / botox (Abbvie); the health insurance oligopoly (United Health); and pharmaceutical innovation (Johnson and Johnson and Merck).

From a technical perspective, after moving sideways for the past three years, the Healthcare Sector has moved above the range and begun to trend higher.

This is the third time that the sector has experienced this sideways / up, stair-stepping pattern in the past 10 years.

The first time resulted in a 37% gain; the second time the sector climbed 75%; and during the current period, its up 21%.

If history is a guide (compliance would say it should not be used as one), the Healthcare sector may just be starting its current move.

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

5. US Election Year Seasonality - a New Scenario

Source: Hirsch Holding / Stock Traders Almanac. Through year-to-date 2024.

Frequent readers know that we often use the seasonality associated with the US Presidential cycle as a guide.

Mainly, the charts we have shown have reflected the incumbent party winning or losing (chart 5 here).

With the US equity market for the most part heading straight up this year, the Presidential seasonality charts that we’ve presented, have not been as helpful as in the past.

However, with the change to the Democratic nominee, we believe that the chart above, which shows US equity weakness in the two months prior to an open field election may be instructive.

Why?

In our view, equity investors do not like uncertainty.

While we don’t officially know the Democratic candidate (it seems like Harris), it is likely that the race will tighten and uncertainty about the Presidential election over the next 3 months will increase.

As a result, we see the possibility of a September / October sell-off leading up to the election.

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security, please do your own research).