Ain't Nothing Going to Break My Stride!

As we near the end of a surprisingly strong (at least for me) Q1 in equity markets, some last charts and thoughts before a holiday weekend. Let's dig in...

1. A Different Way to Consider Liquidity

We have been very focused on the different measures that the Fed and Treasury have implemented to offset and, in some cases, supersede the tightening monetary policy.

We have referred to this as “stealth stimulus” and we have espoused our belief that this has been the foundation of the 2024 “everything rally.”

We most recently wrote about this in Chart 4 here.

At the time, we highlighted our concern that one of the mechanism’s that the Treasury had used to provide stimulus (or at least offset tightening), drawing down its reverse repo (RRP) account was near its conclusion (there are not many reverse repos left to drawdown) and as a result (our view) the Fed had announced that it would slow the shrinking of its balance sheet (shrinking the balance sheet is a tightening policy).

With all of this happening in the background, Torsten Sløk, the former Deutsche Bank and current Apollo economist has another view of liquidity.

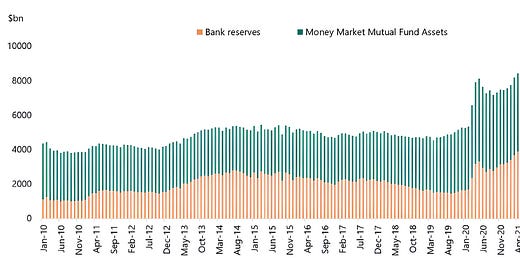

He says that, “one way to measure liquidity is to add bank reserves and money market assets.” (chart below).

Based on this measure, there is record-high liquidity that may be used to push stock prices higher and credit spreads tighter.

Torsten concludes by saying, “in particular, once the Fed starts lowering interest rates, some of the $6 trillion in money market funds is likely to find its way into stocks and credit.”

That said, despite the recent Fed statements, we have expressed our concerns that given inflation trending the higher and tight employment markets, it may be difficult for the Fed to cut rates. (here).

Regardless of whether the Fed cuts or not, if Torsten’s analysis of Bank Reserves and Money Market assets is correct, there remains a lot of dry powder on the sideline.

This is consistent with our view that while we wouldn’t be surprised by a correction, we continue to expect a positive resolution and for the S&P 500 to end the year around 5,500.

(This is not investment advice).

Source: ICI, FRB, Haver Analytics, Apollo Chief Economist. Through year-to-date 2024.

2. Seasonality is Strong with this One

Although seasonality does not drive our investment process, we always want to be aware of the seasonal trends.

During 2022 and 2023, the moves in the S&P 500 were consistent with seasonal patterns of the US Presidential election cycle.

With that in mind, it is interesting to see that April has been the best and most consistent performing month in the S&P 500 during the first half of the year since 1950 and one of the top performing months in US election years. (Past performance is not indicative of future results).

(This is not a investment advice).

Source: TradingView. Through year-to-date 2024.

3. Apple at an Interesting Level Relative to the S&P 500

We looked at Apple shares at the beginning of the month (chart 4 here).

At the time, Apple had just been downgraded by Goldman and the shares had fallen through $181 which had been a recent floor level and an important support in our view.

Today, we are looking at Apple relative to the S&P 500.

When the chart is moving higher, Apple shares are outperforming the index and when it’s moving lower, the opposite is true.

Apple’s peak level of outperformance vs. the S&P 500 was on June 30, 2023 and since then, shares have been underperforming.

In other words, if you are a portfolio manager (or anyone else) that compares your portfolio performance to that of the S&P 500, Apple has been a drag for the past 9 months.

Apple is now at a level on a relative basis (chart below), that has been a battleground and a floor in the past.

We will see if the relative floor can hold as the absolute floor did not.

(This is not a recommendation to buy or sell any security).

Source: TradingView. Through year-to-date 2024.

4. A Look at Global Equities (Part 1)

The chart below shows the MSCI All Country World ex-US Index.

Essentially, the MSCI All Country World ex-US Index is a composite of all non-US equity markets.

After peaking in June 2021 (6 months before the S&P 500), the MSCI Country ex-US fell 33% before finding a bottom in October 2022 (the same time as the S&P 500).

While the S&P 500 has rallied 46% since its October 22 low and has achieved a new all-time high, the MSCI All Country World ex-US is up only 34% and still has not made it back to its 2021 peak.

That said, we want to show this chart to show that global equities in January were able to reclaim the north side of their pre-covid high (the horizontal blue line).

We see this as bullish and another indication of the 2024 “everything rally” that has been characterized by broader participation relative to 2023.

(This is not a investment advice).

Source: TradingView. Through year-to-date 2024.

5. A Look at Global Equities (Part 2)

The chart below shows the MSCI All Country World ex-US (the same chart as above) relative to the S&P 500.

When the chart is moving higher, the the MSCI All Country World ex-US is outperforming the S&P 500 and when the chart is moving lower, the S&P 500 is outperforming the MSCI All Country World ex-US.

Since the end of the Financial Crisis in 2009, the S&P 500 has been outperforming global equities.

While we could list the reasons, monetary policy, emergence of mobile tech, cloud, AI, covid response etc. the key here is the outperformance not the reasons why.

If we have, as an example, $100 to invest.

If we had invested that $100 since October 2022 in the the MSCI All Country World ex-US, it would have made $34; whereas it would have made $46 in the S&P 500.

All else equal (particularly risk), we prefer the $46.

The reason we show relative charts is because our goal is to be invested in out-performers not just shares that are moving higher (unless we view them as future outperformers or they diversify risk).

While many in the investment business preach global diversification, the reality is that it has made no sense to be globally diversified in equities over the past 15 years.

We are also showing this relative chart in conjunction with the absolute chart above to make the point that we tried to make with the Healthcare sector on Tuesday (chart 3 here).

We view the solid performance of the MSCI All Country World ex-US as a part of expanded participation in an bull market (similar to Healthcare) and a new member of what we consider the “everything rally.”

However, just because the MSCI All Country World ex-US is moving higher (like Healthcare) and has moved above a recent ceiling level, doesn’t necessarily mean we want to use our investing bullets on it.

We are off for the rest of the week and will pick it up again on Monday.

For those that celebrate, have a meaningful Good Friday and a happy Easter.

(This is not a investment advice and is not recommendation to buy or sell any security).