The Roaring 20s

The equity markets are continuing their ascent and each day it seems as if a new sector or asset is joining the party. Let's dig in...

According to history.com, the Roaring 20s was a period in American history of dramatic social, economic and political change.

Although the 1920s, were characterized by Jazz music, people moving to cities (for the first time) and consumerism (many brands were launched).

These factors are present today:

Electronic music and DJ culture have become more mainstream (if you don’t believe me, try to go to Ibiza, Mykonos or St. Barths and look up salaries for Calvin Harris, David Guetta or Steve Aoki here;

People may not be moving “to cities” but the post-covid work-from-home migration likely had more people moving than any time in the last 5 decades; and

Consumerism today might be represented by digital creators like the Kardashians, YouTube influencers and can be seen in conglomerates like LVMH.

As we all know, the Roaring 20s ended badly.

The challenges of the Roaring 20s were likely best represented in the Weimar Republic in Germany. (A description here and an interesting essay here).

While we are not at levels of “hyper-inflation,” inflation has been the highest in 40 years we have political extremism, and a growing divide between rich and poor.

The debt level of the US government and more importantly the interest expense (both in absolute terms and as a percent of tax revenues) remain concerns.

As Voltaire said, “History doesn’t repeat itself, but man always does.”

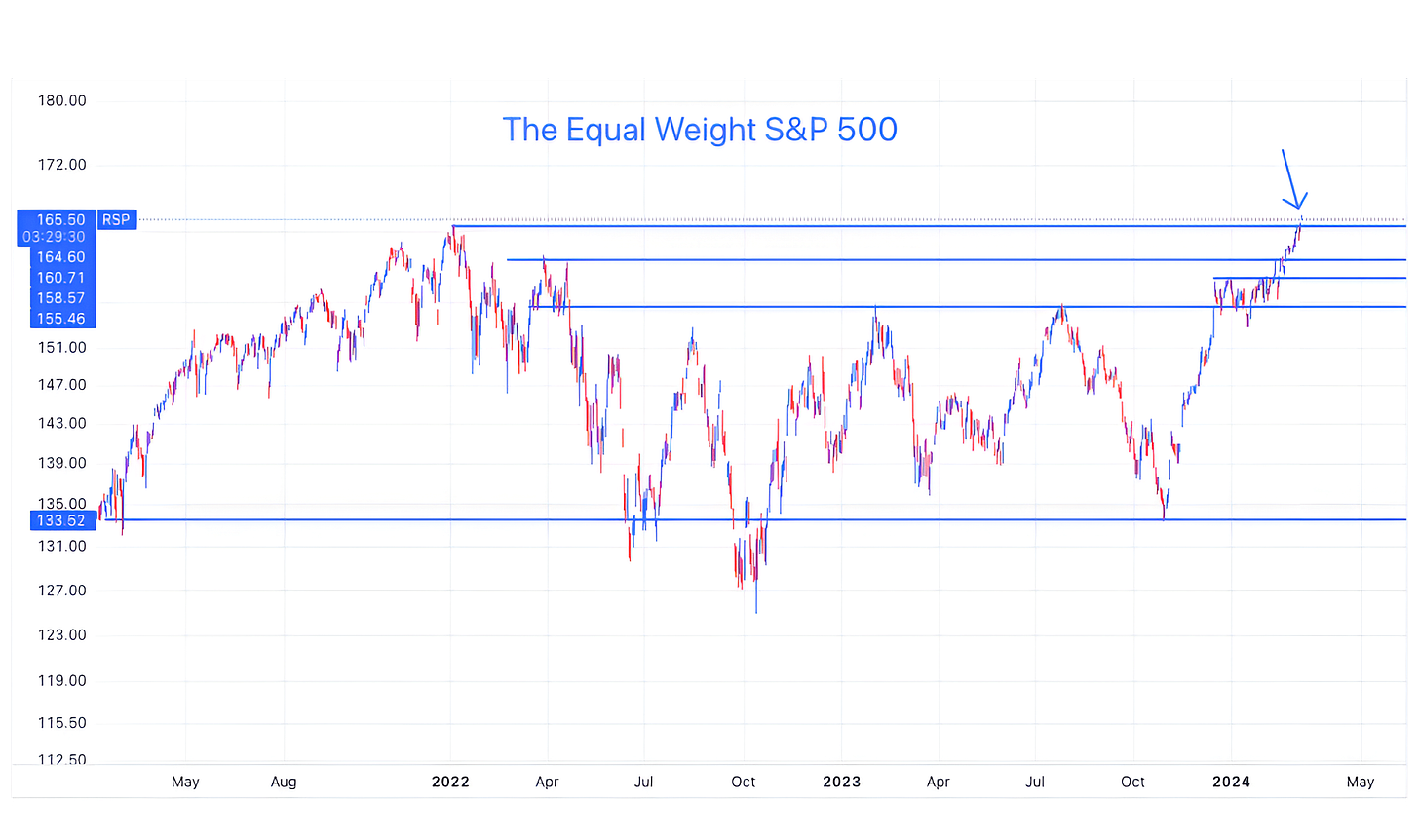

1. The Average Stock at an All-Time High

Nothing says, “This is the Soft Landing” (here); the “Everything Rally” (here); or the “Roaring 20s” like a new all-time high in the Equal Weight S&P 500.

We view the new high in the Equal Weight S&P 500 as a reflection of greater participation in this year’s equity ascent.

While many of the leaders from last year are leaders once again this year, we view the increased breadth as a positive.

Coming into the year, our view was that the outperformance of the Magnificent 7 would moderate and the baton would be handed to the “other 493” to drive the S&P 500 higher.

Although this is less of a handing off of the baton than everything working together, it is somewhat consistent with our outlook.

We want to see if the move to a new all-time high in the Equal Weight S&P 500 is meaningful and sustainable, but for now we view it constructively (see chart 2).

(This is not a recommendation to buy or sell any security, it is not investment advice).

Source: TradingView. Through year-to-date 2024.

2. A Long Time Between New Highs…Bullish!

If the Equal Weight S&P 500 (chart 1) closes at a new all-time high today it will conclude the third longest period between new highs in the index since its inception.

In the 7 other instances when there have been more than 200 days between new highs on the Equal Weight S&P 500, the average return 1-year later has been 12.8% with a high of 29.9% and a low of -2.6%. (Past performance is not indicative of future results).

We find it interesting that the historical return profile associated with the longest streaks for the Equal Weight S&P 500 without a new high are consistent with those that we have shown with respect to four consecutive positive months in the S&P 500 and other technical momentum indicators. (Chart 1 here).

(This is not a recommendation to buy or sell any security and is not investment advice)

Source: Strategas. Through March 5, 2024.

3. That Was Quick!

Exactly two weeks ago, we showed the Semiconductor Sector ETF (ticker: SMH). (Chart 3 here) (This is not a recommendation to buy or sell any security).

At the time, Nvidia had just reported earnings and although we continued to see potential upside in the shares and the Semiconductor ETF overall, our view was that the pace of gains would slow.

We wrote this:

“On the chart, we have noted that the Semiconductor ETF is currently in the 161.8 Fibonacci retracement area of its January to October 2022 sell-off.

If the ETF can win the battle for the north side of this extension, we see the next logical stop at the symmetry level of its last trading range.

This would leave the ETF 9% higher than today’s level at $227. It can certainly move higher, but we see the momentum of extreme growth moderating for the time being.”

I’ve left the original annotations on the chart.

As can be seen, after a very short battle with the 161.8 Fibonacci extension (horizontal line second from the top), the Semiconductor ETF continued its upward journey to our possible “symmetry” target level.

Although Semiconductors may not stop here, we would expect a pause / battle near current levels. As we stated two weeks ago, in our view it is likely that the extreme upside momentum will moderate.

(This is not investment advice).

Source: TradingView. Through year-to-date 2024.

4. My Shoeshine Guy Mentioned this One: Bitcoin

Many of us know the story of Joe Kennedy and the shoe shine boy.

As the adage goes, in 1929, at the height of an economic boom in America (but the end of the Roaring 20s), Joe Kennedy (JFKs father) was working as a stockbroker on Wall Street.

When he went for a shoeshine, the shoeshine boy gave Joe some of his favorite stock picks.

When Joe heard the shoeshine boy giving out stock tips, he figured the party was about to end, and it was time to get out of the market. He exited his positions in the market and bought short positions that bet on the market going down.

While I don’t have a shoeshine boy, it does feel like a number of people have been talking to me about Bitcoin lately.

After climbing 320% from its November 2022 lows, the digital currency is back to its April and November 2021 highs.

We wouldn’t be surprised to see Bitcoin pause near current levels and potentially form the right shoulder of an inverted “head and shoulders” formation. (We’ve drawn this in).

Given its lack of cash flow, Bitcoin trades primarily on supply and demand. Jamie Dimon referred to Bitcoin when he said, “It does nothing. I call it a pet rock.”

While we recognize the demand that has been generated from the launch of the iShares Bitcoin ETF (ticker: IBIT), and supply is constrained by the mandate (although a split is likely coming), it is difficult to have a traditional fundamental view or analysis of Bitcoin. (This is not a recommendation to buy or sell any security).

As a result, in our view, at least a portion of the price appreciation in Bitcoin is due to speculation (which is why we referenced the Joe Kennedy shoe shine story).

This brings us back to two points that we have been trying to emphasize:

The Fed is not as tight as it thinks it is (chart 4 here).

There is no reason to cut rates from current levels, a hike may be more appropriate. (here).

(This is not a investment advice and is not recommendation to buy or sell any security).

Source: TradingView. Through year-to-date 2024.

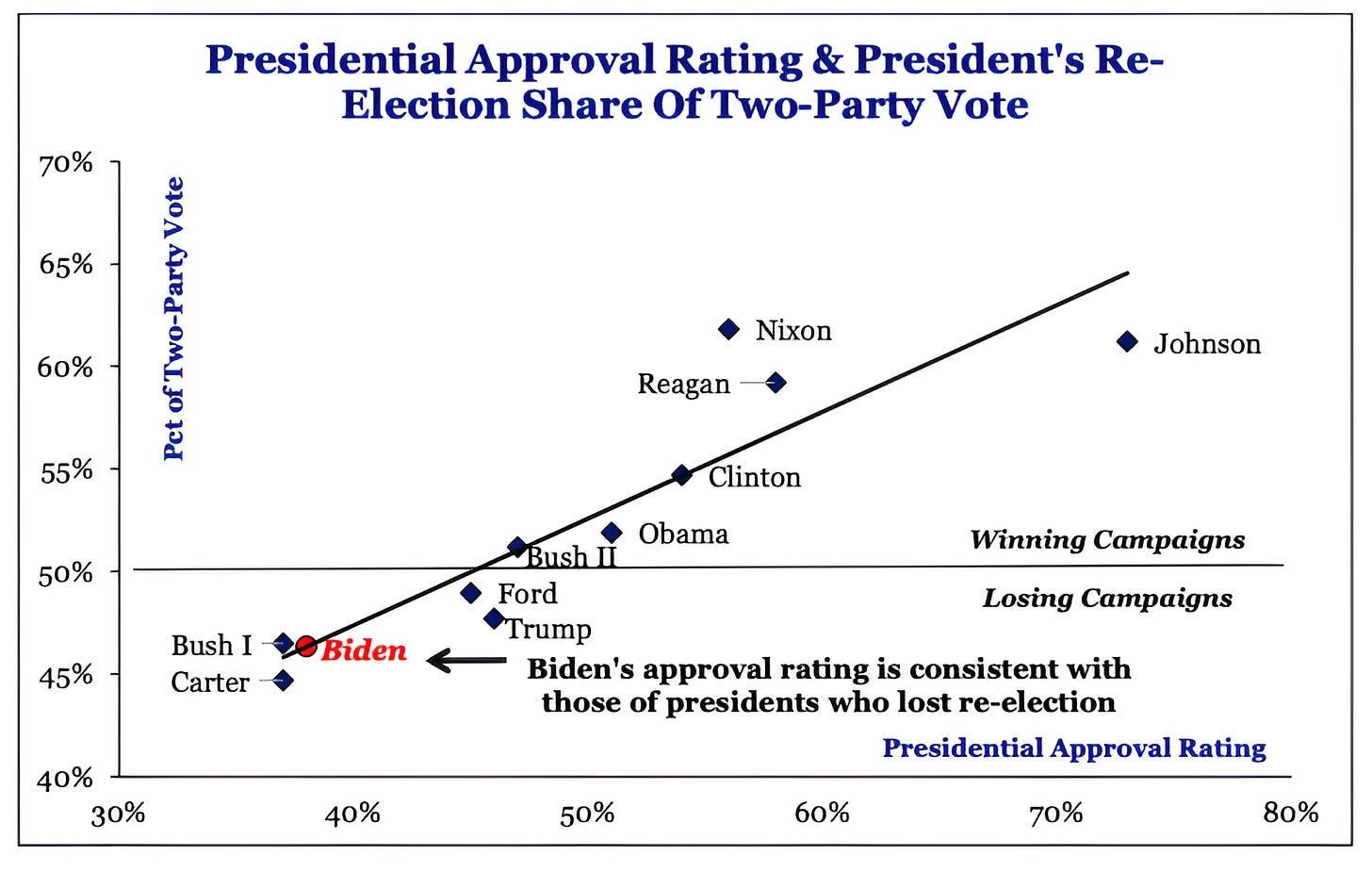

5. State of the Nation

Tonight, President Biden will deliver the annual “State of the Nation” speech.

Although the US has had a more resilient economy over the past two years than many expected and employment remains strong, President’s Biden’s approval is at levels, that in the past, has characterized losing re-election campaigns.

Beyond approval ratings, a number of polls, both national and state by state, reflect an uphill climb for President Biden despite running against a challenger who has four indictments and 91 charges against him.

Tonight Biden will need to demonstrate that he has the strength and capacity to govern for four more years, to draw a contrast with the policies of Trump, and to send a message to voters that he has a better plan for the future.

There are those sectors that many believe will benefit under Biden and and those that can flourish under Trump.

That said, one can look at the under-performance of clean energy vs. oil under Biden and recognize that sometimes what seems likely and obvious isn’t necessarily so.

Typically, the equity market begins to price in the election in August. (Past performance is not indicative of future results).

If President Biden cannot strike the right tone tonight, equities may begin to price in a Trump presidency sooner rather than later.

(This is not a investment advice and is not recommendation to buy or sell any security).