You Spin Me Right Round

On Monday the AI complex sold off; on Wednesday the Fed held rates steady (a dovish pause?) and equities rallied; and Wednesday night questionable earnings were bought. Let's dig in...

On Tuesday, we questioned whether the launch of DeepSeek was the “metaverse moment” we had been considering.

A “metaverse moment” is a reference to September 2021 when investors began to push back against Facebook because of what they considered to be too much capex spending on the metaverse without the prospect of returns.

Given what was seen as questionable allocation of capital, the multiple in Facebook shares began to contract. (Shares peaked two months before the Nasdaq 100 overall, and Meta stock fell 77% over the subsequent 14 months).

With the $270 billion that the hyperscalers are expected to spend on data centers (including chips, power, cooling, etc.) in 2025 (see Chart 4 below), our concern has been that without line of sight to AI revenues or profit, investors may push back - as they did with Facebook and the Metaverse.

If data center capex were to slow or declines, this could lead to significant changes in earnings guidance from many of the companies that led markets higher in 2024 and potentially result in overall equity market volatility.

On Tuesday, we concluded by stating: “At first glance, this looks more like a rotation within equities rather than a broad based rotation out of equities.”

When we consider the rotation, we went back to the introduction in a piece we wrote nearly a year ago that considered the transition from AI 1.0, Semiconductors and Infrastructure; to AI 2.0, proprietary data and software.

Last February (here) (clearly early), we wrote:

“AI 1.0 has been focused on the buildout of data center infrastructure.

It is funded by the capex of companies like Meta (Facebook), Alphabet (Google) and Microsoft (the “hyper- scalers”).

This infrastructure buildout has - and will likely to continue to - benefit hardware providers (“picks and shovels”).

In general, these are companies that specialize in semiconductors, connectivity, data center real estate, power management, cooling and others.

While we continue to like Nvidia and other semiconductor names, we consider these to be AI 1.0.

As AI 1.0 continues (but slows from hyper growth to something closer to more normalized), we also want to begin to consider AI 1.1 and AI 2.0.

AI 1.1, in our view, will likely be a proliferation of AI and machine learning in sensors, the “edge”, robots, biotech, virtual and mixed reality (Apple Vision Pro), and gaming.

All of this will require enhancements to networking and additional memory. (Still more hardware than AI 2.0).

AI 2.0, in our view, will revolve around proprietary data and software.

Proprietary data will be less obvious than the Facebook, Google, Microsoft data that many are focused on today.”

When I consider proprietary data, the obvious examples are insurance and credit card companies.

Rather than marking the beginning of extreme sell-off, we see the DeepSeek announcement as the transition from AI 1.0 to AI 1.1 and AI 2.0. This may lead to some market volatility as it will require adjustments from portfolio managers.

“You Spin me Right Round.”

(As an aside, when I was looking up today’s song by Dead or Alive - who squeaked out of being a one hit wonder with the success(?) of “Brand New Lover” - I couldn’t resist the picture below despite it having nothing to do with pretty much anything.)

1. The Nasdaq 100: An Island? Yes. A Reversal? Let’s See.

Source: TradingView. Through year-to-date 2025.

The chart above is a near-term close-up of the Nasdaq 100 ETF (ticker: QQQ).

As we took a closer look at the post-DeepSeek price action in the Nasdaq 100, we noticed the presence of an “island” formation on the chart (circled in green).

Island patterns are characterized by price gaps (first the “breakaway” gap and then the “exhaustion gap”) on both sides of a cluster of prices within a distinguishable range.

Islands are typically seen as reversal patterns.

According to Investopedia (here): “The appearance of the exhaustion gap is usually the first sign of a new trend which will then include several runaway gaps in the new direction.”

In other words, if the reversal aspect of the island pattern is confirmed - I think a move below Monday’s low would be confirmation - we could expect further downside, potentially in “runaway” fashion.

Although runaway downside doesn’t seem to be the case yet, we have continued to maintain our focus on the 1.618 Fibonacci extension level of the 2022 sell-off at $500.

If we were to move back to this level, it may simply reflect air coming out of the semiconductors (we showed this on Tuesday in Chart 2 here) and other AI 1.0 beneficiaries in favor of other companies rather than a broad rotation coming out of the equity market.

(This is not a recommendation to buy or sell any security and is not investment advice. Past performance is not indicative of future results. Please do your own research and due diligence).

2. Checking in on Value

Source: TradingView. Through year-to-date 2025.

The chart above shows the Russell 1000 Value ETF (ticker: IWD).

We wanted to show this in contrast to the growth-oriented Nasdaq 100.

We showed this chart in mid-December (here) after it had moved down 12 straight days (-6%) and was sitting around its “pre-election” level.

The Russell 1000 Value bottomed shortly thereafter and danced along its 200-day moving moving average for the next month (through mid-January).

With earnings season - and specifically the announcement of well-received earnings from several major financial companies (a primarily value sector) - the Russell 1000 Value has climbed back to the 1.618 Fibonacci extension level of its 2022 sell-off.

We continue to cite this level (across major indexes) and believe that the Russell 1000 Value resolution from its 1.618 Fibonacci extension level and direction from here will provide insight into both the direction and character of the overall market.

(Past performance is not indicative of further results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

3. A Slightly Different Look at Valuation

Source: Strategas and FactSet. Through year to date 2025.

The chart above shows the S&P 500 Median Price to next twelve months (NTM) Earnings.

The idea behind using Median Price to Earnings is to mitigate the impact of the largest stocks which often trade at the highest multiples and are disproportionately represented in the typical index PE (Chart 3 here).

The Median Price to Earnings hit its highest level of the past 30 years during the post pandemic period.

In the post pandemic period, the market priced in a rapid recovery (price moved higher) while analysts did not (earnings estimates remained low). This led to the inflated price to expected earnings (both median and typical).

Outside of the post-pandemic period - and we do not believe we are in a similar environment - the peak in the Median Price to Earnings over the past 30 years has been at essentially the same level where it sits today.

The reason we like this chart, is that unlike the typical PE chart that has major swings and rarely spends time at “average,” the Median Price to Earnings seems to have gravitate to its average line and has revisited it (or close to it) eight times over the past 10 years.

If the Median Price to Earnings were to revisit the average line from current levels, all else equal, this would represent a 17% decline.

Given the strength in the market, a few caveats are warranted: 1) this doesn’t have to happen; 2) the Median Price to Earnings could move higher from here; 3) this is not a timing mechanism - simply something to consider.

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

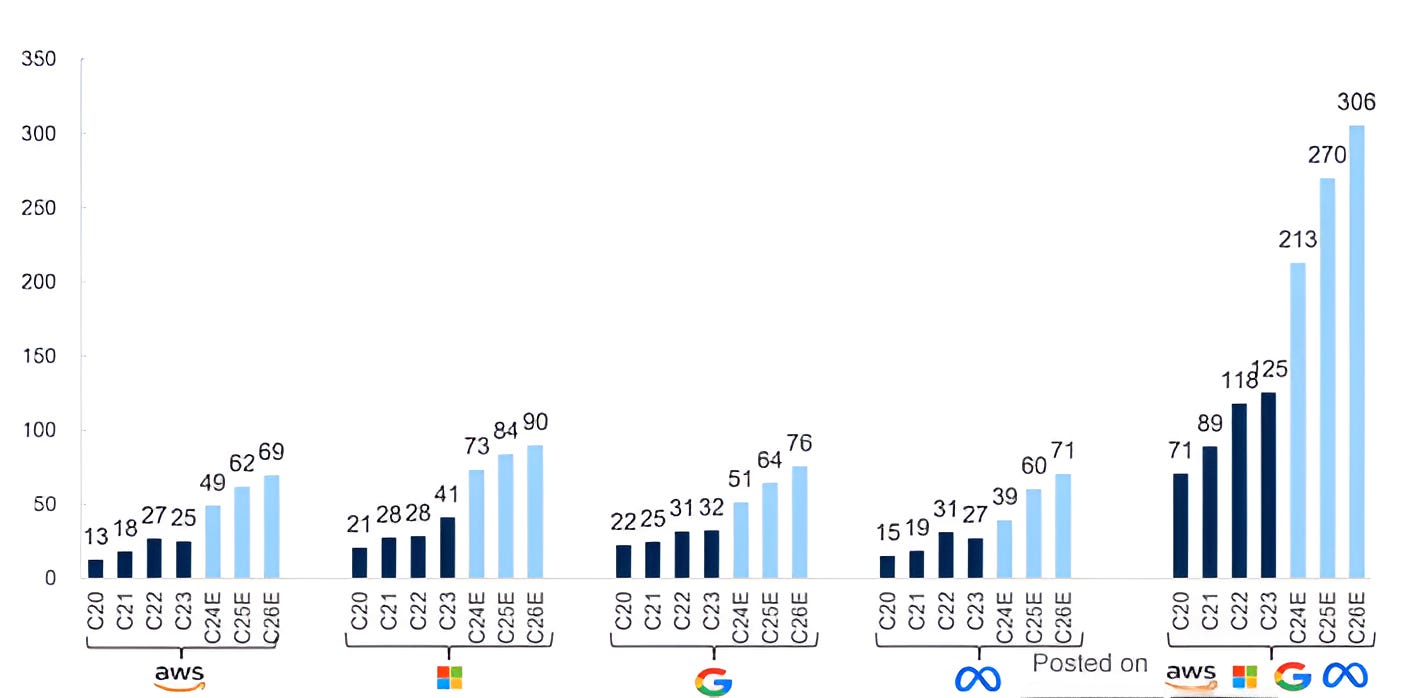

4. Hyper Scaler Capex Spending: the Levels are Set

Source: Strategas. Through year-to-date 2025.

The chart above shows US hyper-scaler capital expenditures (“capex”) in calendar years 2020-2023 (dark blue) and Goldman Sachs estimates for 2024, 2025 and (now) 2026.

This is an update to the same chart that ran through 2025 estimates that we showed as chart 3 here.

The US hyperscalers are from left to right: Amazon; Microsoft; Alphabet (Google); and Meta (Facebook)

The last time we showed this chart, it included Oracle as well.

The chart shows the money (in $ billions) that these four companies are expected to spend primarily on AI infrastructure.

Notably, since we last showed this, the aggregate estimate for 2025 capex has increased from $252b to $270b.

Including the $12b estimate for Oracle (from the last time we showed the chart), hyperscaler capex is expected to be over $280b this year.

This is a huge stimulus to the US economy.

While times have changed and we are not dealing in 2008 dollars, the post financial crisis US fiscal stimulus was $700b. The hyperscalers are expected to spend over $800b (including $35b from Oracle - not shown) from 2024 through 2026.

Unlike some government stimulus, this capex has a significant multiplier effect.

That said, we have continued to write about the risk of what we have characterized as a “metaverse moment.”

We would consider this to be a slowing of or reversal of the intention to spend money on AI capex.

We’re showing this chart to establish an expectation level - we now know what the expectations are and what is priced in.

If reality falls short or if the hyperscalers begin to talk down the expectations, in our view, it could lead to economic and market volatility.

Despite DeepSeek, we have not yet heard of AI capex plans being reduced.

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

5. Chinese Internet Shares Post DeepSeek

Source: TradingView. Through year-to-date 2025.

The chart above shows the Chinese Internet ETF (ticker: KWEB).

We’ve been highlighting this for some time (we last showed the chart here) and had our interest piqued in 2024 when China issued a range of stimulus measures and the Internet ETF rallied to its highest level since 2022.

However, the excitement dissipated and the Chinese Internet ETF fell back to the $26.60 level that has acted as both a floor and ceiling over the past three years.

With DeepSeek, the Chinese Internet ETF is back at its lower ceiling level. We will watch to see the response from here.

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own research and due diligence).