Mama Mia! Here We Go Again.

With the equity markets finally responding to the imbalances that we have been citing - higher inflation, tighter Fed, higher 10-Year Yields, could "Stealth Stimulus" be far behind? Let's dig in...

1. “Stealth Stimulus” to the Rescue (Again)

Source: Strategas. Through year-to-date 2024.

Since early January, we have been focused on the use of the Reverse Repo facility (RRP) and the Treasury’s General Account (TGA) to offset higher Fed higher Fed Funds Rates and Quantitative Tightening (QT) in what we have called “Stealth Liquidity” and “Stealth Stimulus.” (See chart 3 here and chart 2 here).

Perhaps our favorite chart that we’ve shown on Stealth Stimulus is chart 4 here.

On Tuesday, we highlighted the Bizarre Love Triangle of President Biden, Fed Chair Powell and Treasury Secretary Yellen and referenced Bank of America’s Michael Hartnett who said, “The biggest piece of M&A in the past 12 months was the merger of Treasury and Fed.”

While the recent inflation data has had the Fed walk back its view of near-term rate cuts (we wrote “Will the Fed’s Next Move be a Hike on March 1 here), what we think will happen is that while the Fed will talk “tight,” it will continue to conspire with the Treasury to provide “Stealth Stimulus.”

The chart above shows the Treasury General Account (TGA).

Yellen essentially used the TGA last year to offset tight conditions during the debt ceiling debate.

Since that time, the preferred “Stealth Stimulus” tool has been through the Reverse Repo facility and in the background the Treasuries General Account has been “reloaded.”

With a weak tax backdrop and spending on Ukraine and other items accelerating, the Treasury could find itself short on cash again and forced to considering an increase of note and bond issuance.

Last year (August through October), the issuance (supply) to fund the surprising deficit (caused partially by disappointing tax receipts), led 10-Year Treasury yields up to 5%.

Because of the Fiscal Dominance regime in the US (we discussed this in chart 2 here and more recently, in chart 2 here), the US cannot afford interest rates to move higher than where they are (truthfully, we can’t afford them where they are).

With the Treasury General Account balance likely to approach $1 trillion later this month, rather than issue new notes and bonds and potentially face higher yields, we believe the Treasury will likely use the cash from its general account to cover any fiscal funding gaps.

Combined with tapering of quantitative tightening (slowing the reduction of the balance sheet), using the Treasury General Account to fund the deficit will once again provide “Stealth Stimulus” as we approach the US Presidential election.

This will likely lead Treasury Yields lower, equities higher and the dollar weaker.

In this way, bad news on the fiscal side (too much spending), may be good news for equities and other risk assets by triggering a liquidity response from the Treasury.

While the equity correction may have further to go, we believe “Stealth Stimulus” will once again be the resolution and will save the S&P 500 from moving below 4800.

“I've been cheated by you since I don't know when…So I made up my mind, it must come to an end…Look at me now, will I ever learn…Mama Mia! Here we go again.” Abba

(This is not a recommendation to buy or sell any security and is not investment advice).

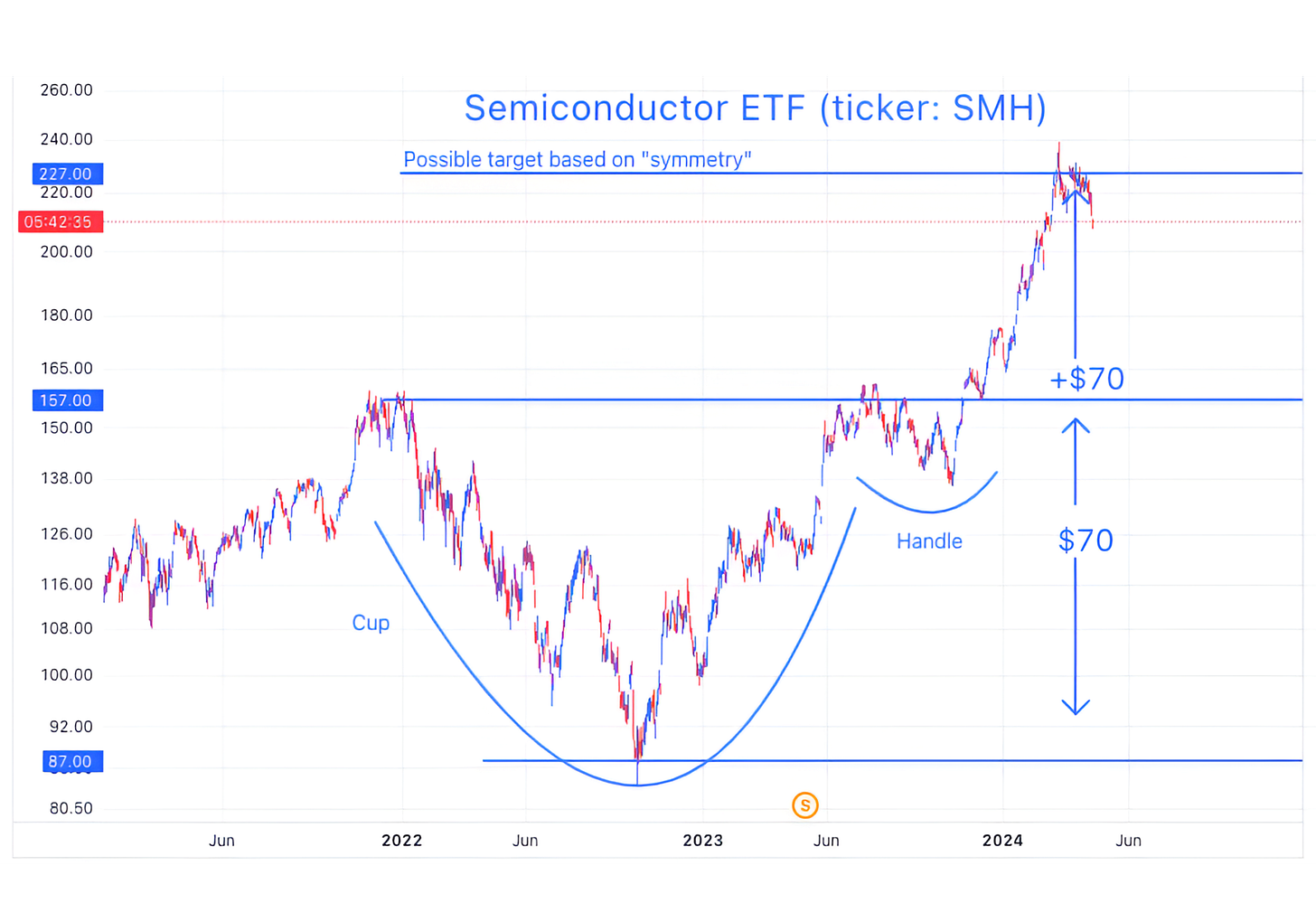

2. Revisiting the Semiconductor Index

Source: TradingView. Through year-to-date 2024.

Nearly, 2 months ago, on February 23, I originally posted the chart above that showed the possible upside in the Semiconductor ETF (ticker: SMH) based on “symmetry.” (here)

The point of that entire piece “Where the Puck is Going” was that while many were still focusing on Semiconductors as the way to invest in AI, we wanted to begin to consider the next wave of AI beneficiaries.

We viewed Semiconductors as beneficiaries of AI 1.0 and we were looking for beneficiaries of AI 1.1 or 2.0.

Despite the fact that our target looks prescient in the Semiconductor ETF, the stocks that we highlighted as potential AI 1.1 and 2.0 candidates have not begun to exhibit any significant AI benefits in their results or their share prices.

Right now, in fact, there does not seem to be a “killer app” for AI.

The obvious killer app for AI has been Chat GPT; however, the number of monthly visits (a proxy for usage) to Chat GPT peaked last April / May at 1.8 billion and has been trending around 1.6 billion ever since.

Has anyone begun using Microsoft Bing over Google for search because Microsoft has integrated AI? I know I haven’t.

We will listen throughout earnings season for true AI use cases.

While a number of companies will mention AI, but few will see a sales increase or a meaningful expense reduction due to AI.

Pivoting back to the chart above, when I first learned about technical analysis (the study of investor psychology, money flows, price history and charts), it made little sense to me.

Why would price act in a certain way? Were there enough buyers and sellers to make certain levels important? Given charting software and algorithms was technical analysis simply a self-fulfilling prophecy?

Over time, I saw enough instances of predictable price behavior and important “levels” to convince me that, at the very least, technical analysis deserved a place along side fundamental analysis in my investment process.

In cases when my fundamental analysis was suggesting one thing - a buy or a sell - and the charts reflected the opposite, I needed to double down on my fundamental work to understand what others were seeing that I was not.

One of the tenets of technical analysis is that price action is symmetric.

After price trades in a range, the magnitude / width of the range, often equals the upside (or downside) move out of the range.

We have also drawn in a “cup and handle” formation on the chart above (it was not on the original chart in February).

The measured target of a “cup and handle” exhibits similar symmetry. The top of the cup to the bottom should equal the upside move.

(This is not a recommendation to buy or sell any security).

3. Financial Sector, A Typical Retracement (So Far)

Source: TradingView. Through year-to-date 2024.

Nearly a week after JP Morgan kicked off US earnings season, the Financial Sector ETF (ticker: XLF) looks to have collapsed.

However, taking a closer look, the story may be more nuanced and potentially constructive.

After its 5-month (end of October to beginning of April) 34% rally back to its all-time high, the Financial Sector ETF, paused and moved sideways waiting for earnings.

Although financials earnings have been relatively solid across the board, after the big move higher in a short period of time, investors looked for reasons to sell - not enough net interest income here, fixed income trading light there, investment banking revenues miss there.

The truth is earnings across the financial sector have been good.

The large institutions that are in the Financial Sector ETF are taking share, have great balance sheets and are performing well.

From a technical perspective, the recent drop in the Financial Sector ETF was a typical .236 Fibonacci retracement after a big run.

While it could go further (down to a .382 Fibonacci retracement), we would ascribe that a relatively low probability in the very near-term.

Like several of the charts we showed on Tuesday, we would expect the Financial Sector ETF to at least a pause at current levels if not bounce back towards the recent highs.

(Past performance is not indicative of future results, this is not a recommendation to buy or sell any security and this not investment advice).

4. A Good Place for a Pause: Oil

Source: TradingView. Through year-to-date 2024.

We last showed oil a little over two weeks ago (here).

At the time, it had moved above $81 per barrel, a level we highlighted, and was trading around $85.

We highlighted $89 as the next likely upside objective.

Although oil traded above $87 per barrel, a funny thing happened on the way to $89.

After Iran attacked Israel last weekend, oil prices dropped, almost in a straight line, from $87 (last Friday) back to the $81 level today.

Often when there is heightened conflict in the Middle East, oil prices move higher not lower.

Was the move lower because economic growth prospects have been reduced given a tighter than expected Fed?

Was it because the bombs from Iran were largely intercepted and, therefore there is a lower likelihood of escalation?

Was it because the Biden administration knows the sensitivity of the US electorate to oil prices and has been aligning itself more with Saudi Arabia (notice the coordination in between the US and Saudi Arabia in defending Israel) to keep oil in check?

While we can never point to a reason for a price movement with certainty, we can say that with oil price back down to $81, in our view, this is a good place for a pause or bounce.

As we are longer-term oil bulls, our expectation would be for a bounce.

(This is not a recommendation to buy or sell any security)

5. A Long-Term Look at the Brazilian Bovespa

Source: TradingView. Through year-to-date 2024.

Over the past 15 years, the Bovespa has primarily traded in two main ranges from 45320 to 71135 until 2017 and from 96950 to 119855 from 2019 to November 2023.

After moving out of its upper range late last year, the Bovespa was able to revisit its June 2021 high and make a new all-time high in January 2024.

Since then, the index has slowly been trending down.

The key area for the Bovespa - if it goes there - will be 119855, the ceiling level of its former range.

If the index moves back to 119855, we want to see if it can hold the north side or if it trades back into the range.

Obviously, holding the north is the more bullish of the two scenarios.

(This is not a investment advice and is not recommendation to buy or sell any security).