The Half of It, Dearie

The first half was surprisingly strong for US equities. Below, we present our view of the opportunities and challenges in the second half of 2024 and beyond. Let's dig in...

1. The S&P 500: Where Do We Go From Here?

Source: TradingView. Through year-to-date 2024.

The chart above shows the S&P 500 and includes our near-term technical target of 5560 (top horizontal light blue line).

Our near-term technical target is based on the 1.618 Fibonacci extension of the January to October 2022 sell-off.

While I know this sounds like non-sensical voodoo, in my experience, Fibonacci levels (both retracements and extensions) have more relevance than one might expect.

As an example, the recent March 28 high was at the 2.618 extension of the February to March 2020 covid related sell-off.

Why does it work? I have some theories but I cannot be sure, but it works more than I would consider.

In any event, as we have been writing for the past month (here), we see this level as a likely destination, but would expect at least a pause upon arrival.

Our fundamental year-end S&P 500 target of 5500 is based on 20x 2025 earnings of $275 (slightly lower than current consensus).

We recognize that the S&P 500 has already surpassed our year-end fundamental target, and (prior to the surpassing) we wrote that “it is possible in a blow-off top type scenario that the S&P 500 could move to 5600 or even 5800.” (in the introduction here).

What would drive the S&P 500 to those levels?

An increase in 2025 earnings expectations. Analysts are now expecting $280 in 2025 S&P 500 earnings. Applying our multiple of 20x would lead to 5600.

An increase in the multiple - perhaps driven by the indication of a likely Fed rate cut. A 21x multiple on $280 in earnings would lead the index to 5880.

Either of these scenarios will likely be impacted by or predicated on the results and outlooks in the upcoming earnings season.

In the same note a month ago, we also wrote:

“Although it’s a fools errand to try to develop a 6, 12 and 18-month road map for the equity market, we see the possibility (10-15% likelihood) of a 30% sell-off that see the S&P 500 bottom around 4000-4200 in 2025 from a peak of 5500-5800 in 2024.”

We found it notable that BCA research this week stated (literally) the same view of a 30% sell-off. (You read it here first).

We, like BCA, are seeing an increasing likelihood of a economic slowdown. (see chart 2 below).

With that in mind, I would increase the odds of a 30% sell-off from 10-15% to 15-20%. Still not our “base case” but odds are not going down in our opinion.

To summarize (tldr in today’s parlance), we see further 3-6 month US equity upside driven by momentum; AI; a constructive earnings outlook; and a likely Fed cut announcement - followed by a sell-off due to slowing economic growth; disappointing earnings; and a contracting valuation multiple (see chart 4 here).

(This is not a recommendation to buy or sell any security and is not investment advice. Please do your own research and due diligence).

2. Clouds on the US Employment Horizon

Source: BCA Research. Through year-to-date 2024.

The top panel of the chart above shows US employment; the middle panel shows the “Mel” rule; and the bottom panel shows the “Sahm” rule.

The “Sahm” rule shows the difference between the 3-month average US unemployment rate and the 12-month low.

Historically, the “Sahm” rule has indicated a recession (grey shaded areas) when the 3-month average US unemployment rate has moved 0.5% above the 12-month unemployment rate low.

The “Mel” rule is similar to the “Sahm” rule but it aggregates state level data.

The “Mel” rule has has indicated a recession (grey shaded areas) when the aggregated state level unemployment has moved 0.25% above the 18-month unemployment rate low.

The “Mel” rule has now “breached” the 0.25% recession threshold.

We would not take this signal in isolation, but it is accompanied by corporate CEOs talking about expense management (see chart 5 here) which we believe is code for future layoffs as well as a debt maturity wall (chart 4) that may be a challenge.

Furthermore, as we have highlighted with the inflation expectations, many consumers are already feeling stretched. (chart 4 here).

(This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

3. Our Concern With Future Earnings Growth

Source: Strategas. Through year-to-date 2024.

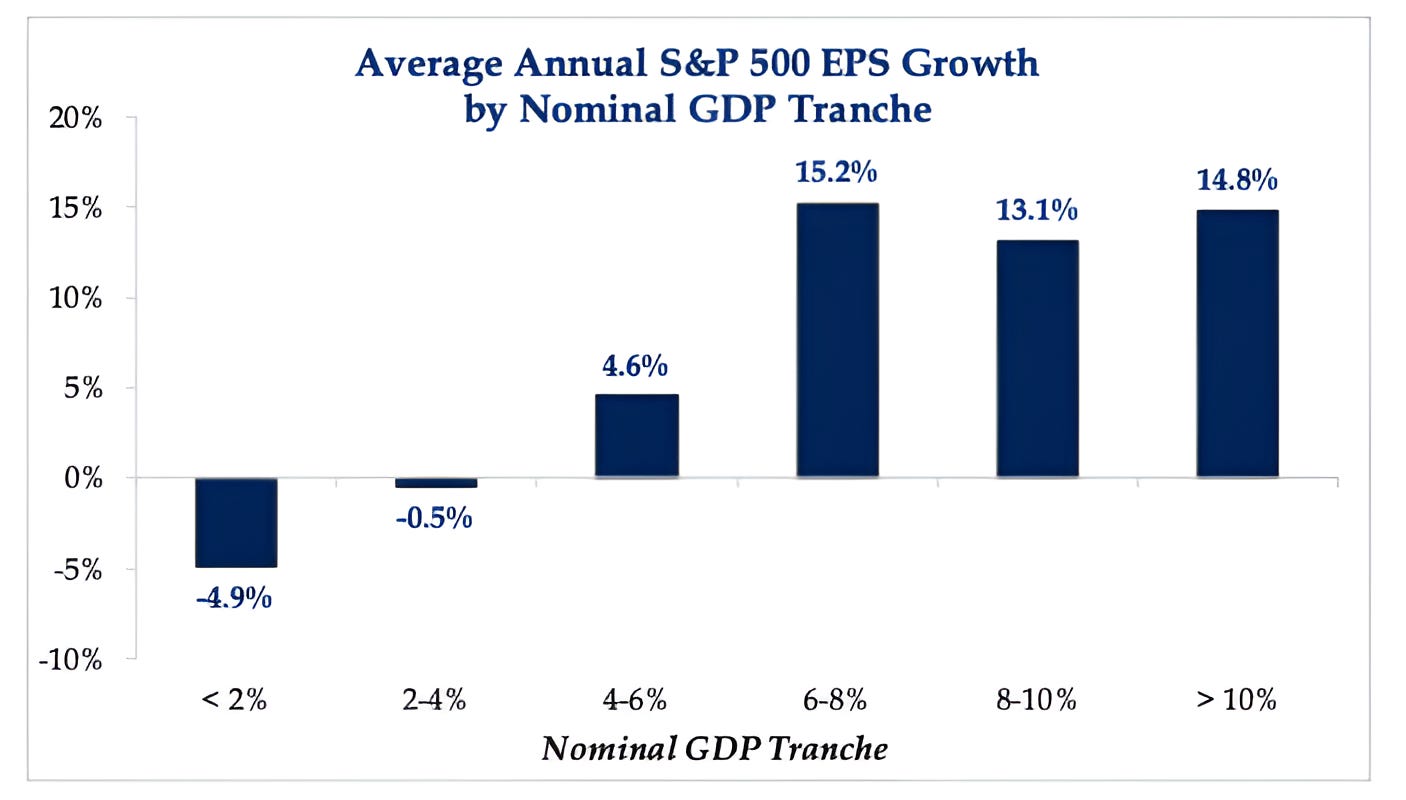

The chart above shows the Average Annual S&P 500 earnings per share (EPS) Growth by Nominal GDP Tranche.

We have written about our concern for US corporate earnings growth to meet what we have considered to be a challenging hurdle several times (most extensively here.

We believe that US nominal GDP growth may be slowing with the likely 2025 level in the 4-6% tranche (2-3% inflation + 2-3% growth).

Historically, when nominal GDP growth has been in the 4-6% range, earnings growth has averaged 4.6%.

2025 S&P 500 estimated earnings growth is currently forecast to be 14%.

This does not necessarily mean that companies will miss earnings expectations, nor does it mean that if they do miss expectations that shares will fall.

It does, however, illustrate the challenge of earnings growth in the current environment, and, as we have mentioned and shown, we continue to believe that equity valuations are demanding and potentially fragile, particularly if expectations are not met.

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

4. The Upcoming Debt Maturity Wall

Source: Bank of America. Through year-to-date 2024.

The chart above shows the percent of S&P 500 (red) and Russell 2000 (yellow) long-term debt maturing in each of the upcoming years.

Beginning in 2025 an increasing amount of long-term debt will either need to be retired or, more likely, refinanced.

Most of the debt that will be refinanced will do so at higher rates.

In speaking with a number of friends in private equity, their companies in general, are facing a challenging operating environment (we have written about the real economy vs. the AI economy) characterized by slowing growth and often decreasing margins (little pricing power and increasing labor costs).

Higher interest rates will put pressure on profitability and, in some cases, will be difficult to manage.

While this maturity wall will not necessarily be detrimental, it may be a headwind to future growth.

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security, please do your own research).

5. All Time Highs Have Historically Preceded More All Time Highs

Source: Carson Research / Ryan Detrick. Through year-to-date 2024.

The chart above shows the times that the S&P 500 has achieved 20 or more all-time highs in the first half of the year and what has happened during the second half.

We have shown many momentum type of statistics (positive markets tend to follow positive markets) in the past including on Monday (chart 4 here) and to a certain extent in chart 3 here.

Momentum is the most persistent factor in US equity markets.

What this means is that momentum (direction of the market) is a better indicator of future performance than valuation, quality (ROE), cap size (large vs. small), or style (growth vs. value).

As can be seen from the chart above, those US equity environments that have established 20 or more all-time highs in the first half of the year have on average added another 6% in the second half of the year and have had positive second half performance 80% of the time.

We will see if this is once again the case.

I am traveling and will write again next Tuesday.

(Past performance is not indicative of future results. This is not a investment advice and is not recommendation to buy or sell any security).