Fly Me to the Moon!

With Fed cuts, a soft landing and Trump 2.0 being priced in, our S&P 500 5600 to 5800 blow-off top scenario has developed. That said, while remaining invested, we continue to see risk. Let's dig in...

1. Last Week’s Rotation in Context

Source: TradingView. Through year-to-date 2024.

The chart above shows the Nasdaq 100 relative to the Equal Weight S&P 500. We last showed this chart here.

At the time, we wrote “In our view, this relationship is a great way to capture the overall market character and any potential rotation.”

With last week’s lower-than-expected inflation data and increasing expectations that the Fed will cut rates (see chart 2), the market rotated away from the Magnificent 7 (Nasdaq 100) and into the “real economy” (the Equal Weight S&P 500).

The lower than expected inflation gave investors confidence that the Fed rate cut cycle is coming (see chart 2) and that the rate cut cycle will lead to a soft landing (in other words, no recession).

As we expected, the chart above captured the rotation.

It is interesting to us that the relationship looks headed straight down to the 1.618 extension level of the December 2021 to January 2023 sell-off that we cited as an important area the last time we showed the chart.

Many have pointed to the rotation and the broader participation that characterized last week’s US equity markets as the hallmarks of a bull market.

However, as the relationship above heads back to our target area, we prefer to withhold judgement on the overall move.

While we have expressed our concerns about the lack of participation in the advance, we have also been focused on the fundamental issues of earnings, earnings growth and valuation.

We are continuing to watch earnings season closely as US equities trade at a premium valuation relative to their history (chart 4).

While rate cuts are likely necessary given some of the imbalances in the economy that we have cited (we highlighted our view that the US economy and equity market seem to be experiencing two parallel and, at times, contrary realities in the introduction here), given the deterioration in the employment data, it is not clear to us that rate cuts will be a panacea that can comprehensively address the issues.

Within this context, we maintain our view of the S&P 500 (here):

In our view, the rally will continue for the next 3-9 months driven by technicals and seasonality and supported by stealth liquidity and the expectation of improving fundamentals.

While our S&P 500 target is 5500, it is possible in a blow-off top type scenario that the S&P 500 could move to 5600 or even 5800.

However, we continue to believe that at some point, the “bill will come due” in this market and a more extreme correction (~30%) will take place.

In our view, this is likely to occur within the next 6-18 months.”

(This is not a recommendation to buy or sell any security and is not investment advice. Please do your own research and due diligence).

2. Fed Funds Expectations…

Source: Charlie Bilello / Creative Planning. Through year-to-date 2024.

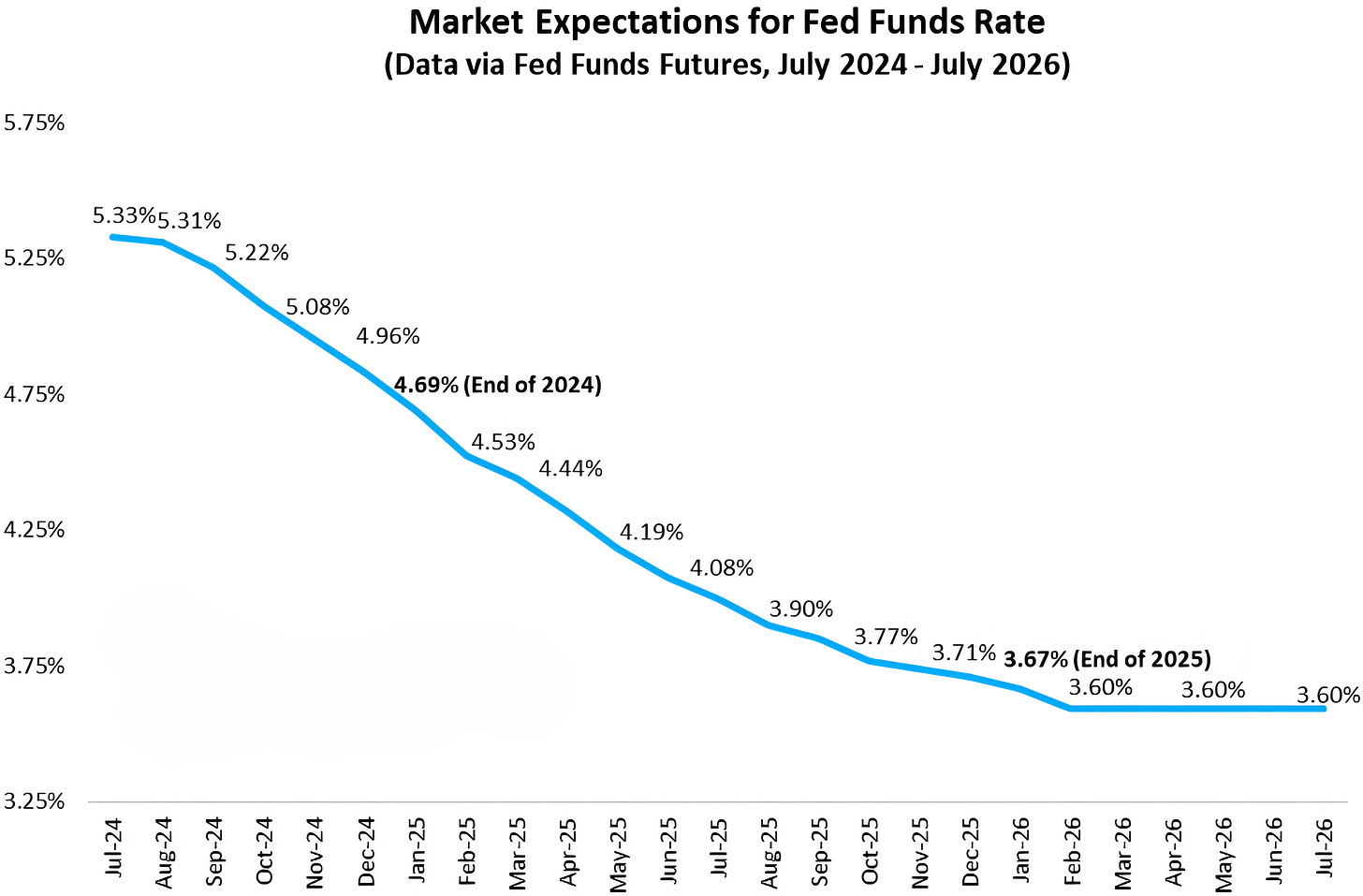

The chart above shows the market expectations for the path of the Fed Funds rate.

Currently, investors are pricing in three 0.25% Fed Funds cuts by the end of 2024, most likely beginning in September.

For 2025, investors have priced in another 1.00% of cuts.

While the additional liquidity is perceived to be a positive for equity markets, Fed cutting cycles, have at times been, “buy the rumor, sell the news” events. (see Chart 5).

Investors may, at some point question, what type of economic environment warrants 1.75% of Fed rate cuts over 18 months.

(This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

3. Trump 2.0 Looking More Likely

Source: Polymarket. Through year-to-date 2024.

In general, I aim to avoid politics in these notes.

However, from the debate to the events of the past couple of days, the character of the US Presidential election has evolved in a way that will likely impact markets.

Although I am not sure of the accuracy of the map above, the conclusions seem somewhat consistent with most of what I’ve been reading, and, as a result, it warrants some consideration.

It should be noted there are four and half months to the election, and, as we have seen, the landscape can shift quickly.

When we look back at Trump 1.0, perhaps three of the most defining economic characteristics were: 1) corporate tax cuts / stimulus; 2) trade protections through renegotiations of trade deals and tariffs; and 3) de-regulation.

While the corporate tax cuts led to a one-time step up in S&P 500 profitability, they also increased the US deficit.

Frequent readers know that a theme of ours has been fiscal dominance (see chart 5 here; chart 5 here; chart 2 here; and chart 2 here).

Despite the recent move lower in 10-year US Treasury yields, we continue to see the possibility that the bond market will demand fiscal responsibility from the US through higher borrowing costs (yields).

Furthermore, if Trump 2.0 emphasizes trade protections, this may be inflationary. Inflation often pushes longer-term bond yields higher and is associated with lower equity valuations.

Although the increasing possibility of Trump 2.0 seems as if it is working in tandem with the prospect of rate cuts to broaden the equity market rally and drive markets higher, over time, this too could turn into a “buy the rumor, sell the news” scenario if bond markets fail to support the vision.

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

4. Continuing to Watch Valuation

Source: FactSet. Through year-to-date 2024.

One of our more significant concerns in the current equity market environment is valuation.

The chart above shows the S&P 500 price to expected earnings for the past 10 years along with the 10-year and 5-year averages.

While we recognize that valuation is not a catalyst (a market that is expensive does not “need” to sell-off and a market that is cheap does not “need” to rally), we believe valuation is a measure of risk.

We view the current market environment as risky.

If we were to look back at valuation over the past 25 years, it would be easy to see that prior to the current period, there have been two valuation bubbles in the US.

The first was during the dot-com bubble and the second was in the post-covid period. Both ended significantly with lower valuations.

After the dot-com bubble, the ultimate valuation lows were around 12x forward earnings. In the aftermath of covid, as can be seen, valuations bottomed just above 15x.

While we cannot predict timing, our expectation is that at some point equity valuation will compress.

However, it should be noted that the multiple compression in both the dot-com bubble and the post-covid period were preceded by Fed tightening. As noted above, the market is currently expecting easing.

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security, please do your own research).

5. Fed Rate Cuts Have Foreshadowed Equity Challenges

Source: Strategas. Through year-to-date 2024.

The chart above shows the change in the S&P 500 from the first Fed rate cut in past cycles to the low in the index (y-axis) and the number of trading days from the first rate cut to the S&P 500 low (x-axis).

On average, since 1970, the S&P 500 has declined 23% over the 10-months (213 trading days) following the first Fed rate cut in the easing cycle. (Past performance is not indicative of future results).

We see this as consistent with our view that over the next 6-18 months there is an increasing possibility of a 30% drawdown within the S&P 500 as a combination of elevated earnings expectations, slowing growth and a premium valuation are reconciled.

(This is not a investment advice and is not recommendation to buy or sell any security).