Radioactive!

With the election here, a topic that neither candidate is talking about is US debt. One of our main themes has been Fiscal Dominance. We're keeping an eye on markets, rates and policy. Let's dig in...

As politics has invaded every corner of discourse in the US - even the commentary on the World Series somehow became political - I have tried to keep these notes purely focused on markets and apolitical.

However, we recognize that policy - fiscal, monetary and legislative - has a major impact on markets.

While it is easy to focus on regulation, tariffs and taxes, our emphasis has been on monetary policy, both traditional and “stealth” (see here, here, here, here, here, here, here, chart 4 here and here). (We often reference Stan Druckenmiller in saying that it’s liquidity that moves markets).

Within that context, we continue to believe that the deficit and the concept of Fiscal Dominance (see here; here; in chart 5 here; in the introduction here; chart 2 here; and chart 2 here) are key considerations.

Fiscal Dominance is the idea that government debt outstanding and interest payments are so great that they impact central bank policy decisions.

Regardless of who wins the election, the debt outstanding and interest rate expense are likely to impact the fiscal and monetary policy of the next four years and by extension equity and fixed income markets. (See charts 3 and 4 below).

As always, rather than react prematurely, we are watching the charts of key indexes and relationships. We have continued to navigate the environment by remaining invested while buying puts and put spreads (see two week ago here).

In the meantime we continue to view the election as Radioactive.

1. The Battle from the North in the Dow Industrials

Source: Trading View. Through year-to-date 2024.

The chart above shows the Dow Industrials Index.

We showed this a week ago (here).

At the time, we characterized the Dow Industrials Index as fragile as it seemed to be heading down for a “re-test” of the 1.618 Fibonacci extension of its 2022 sell-off at 42000.

On Tuesday, we showed the chart of the Nasdaq 100 ETF (ticker: QQQ) (here).

The Nasdaq 100 ETF had moved up and was battling the 1.618 Fibonacci extension of its 2022 sell-off at $496.

We continue to highlight these two indexes, as each is contending with the key level that we identified (here); however, one index is re-testing from above while the other is trying to capture the north from below.

In our view, the resolution for each of these could set the tone the for equities in the near term.

This morning, theres seems to be some downward resolution, however, we would hesitate to call it definitive.

Although is not shown in this note, after moving above $500 on Tuesday afternoon, the Nasdaq 100 ETF is trading below our key level of $496 at $485 today.

As we wrote last week:

In our view, if the Dow Industrials does come back down towards 42,000, its reaction - either a bounce or a drop through - will be a barometer for what may be in store for the S&P 500.

As can be seen on the chart above, the Dow Industrials has come back to 42,000 and fallen below.

The S&P 500 remains 2% above the 1.618 Fibonacci extension of its 2022 sell-off, but the more time the Dow Industrials and Nasdaq 100 spend below their respective key levels, the greater the gravitational pull will be on the S&P 500.

(This is not a recommendation to buy or sell any security and is not investment advice. Past performance is not indicative of future results. Please do your own research and due diligence).

2. An Interesting Relative Spot for Financials

Source: Trading View. Through year-to-date 2024.

The chart above shows the Financial Sector ETF (ticker: XLF) relative to the S&P 500.

When the chart is moving higher, Financials are outperforming and when the chart is moving lower, Financials are underperforming.

While the Financial Sector ETF includes traditional banks such as JP Morgan (9.5%), Bank of America (4.2%) and Wells Fargo (3.1%), the largest position is Berkshire Hathaway (13.4%) and the ETF also holds Visa (7.3%) and Mastercard (6.5%).

Despite its diverse allocation - as can be seen on the chart above - the Financial Sector ETF never fully recovered from the March - June 2023 Regional Banking crisis.

If we were to look at the chart of the Financial Sector ETF on its own (not relative), it is one of the better looking charts in our work.

Since early August, the Financial Sector ETF is up 17%.

Financials are now making their second attempt since July to cross back to the northern hemisphere of the relative chart.

In our view, a portion the rally since August and a justification for the recent outperformance may be due to investors considering a Trump victory.

Financials were one of the best performing sectors after Trump won the 2016 US Presidential election.

With Financials hovering at the Maginot line, investors may be waiting for the election outcome to determine the next move in Financials relative to the S&P 500.

(Past performance is not indicative of further results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

3. The Harris and Trump Plans…

Source: UBS. Through year to date 2024.

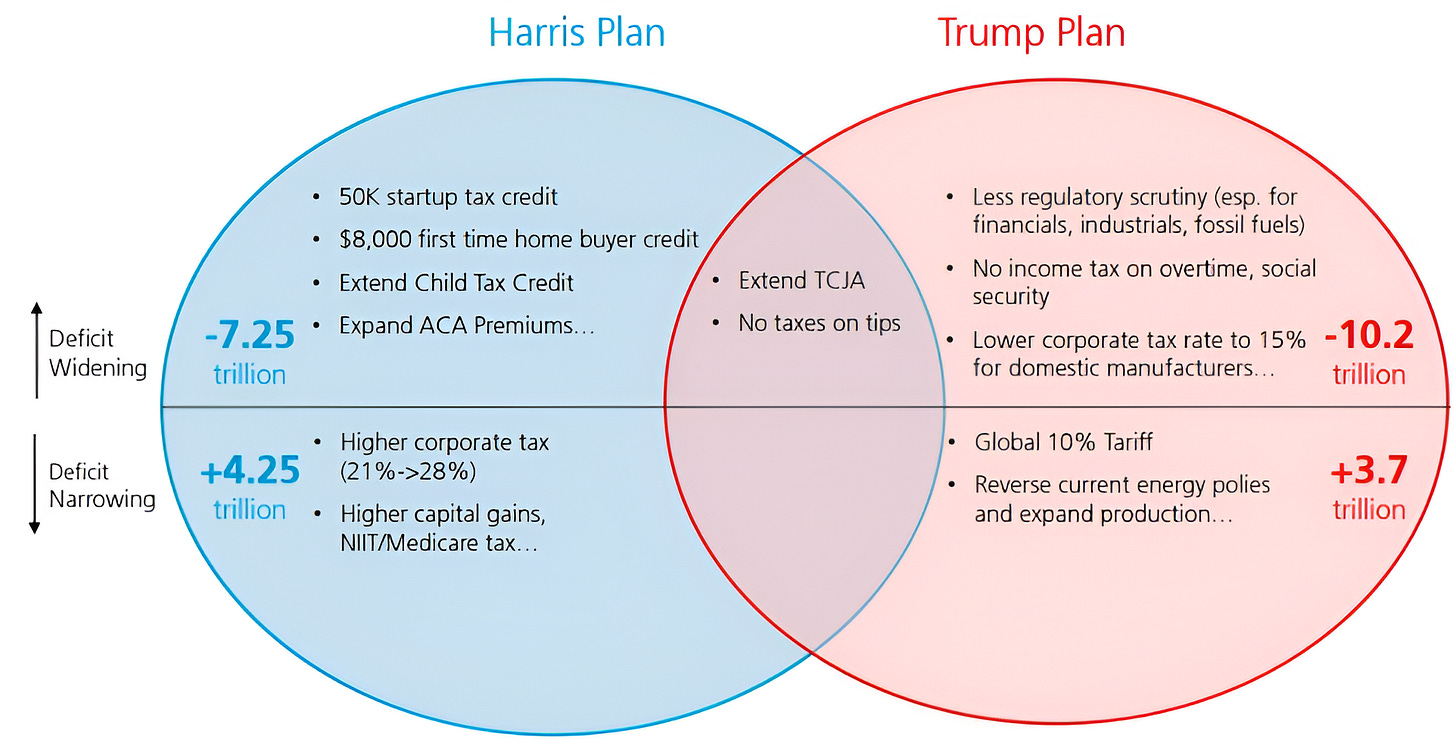

The chart above from UBS is a simplification of the Trump and Harris plans and how they might impact the US deficit.

First, we should say that we have never seen estimates of spending that are accurate so we need to take this with a grain of salt.

Second, we will not opine on the policies included other than from a market perspective.

As we consider markets, it seems that fixed income investors have focused more on debt issuance, deficits, and inflation, while equity investors continue to price in a rate cuts a soft landing and continued stimulative policies.

The one portion of policy that it seems both parties agree on (the overlap in the venn diagram above) is the extension of the Tax Cuts and Jobs Act (TCJA).

The TCJA is the Trump policy from 2017 that cut the corporate tax rate to 21% and capped deductions for state and local taxes (SALT) at $10,000.

While the TCJA led to an immediate step up in S&P 500 earnings due to the lower corporate tax rate (24% earnings growth in 2018), we do not expect a similar step up with an extension.

That said, within Trump’s plan (top right), we can see he intends to lower corporate taxes again from 21% to 15% while Harris’ plan calls for the corporate tax rate to increase from 21% to 28%.

If Trump wins and this becomes a policy, as we have stated in the past, equity markets might look through soft / disappointing 2025 earnings to a better 2026.

Whereas, if Harris’ plan were to pass, we would likely see a step-down in 2026 earnings expectations.

Overall, both plans will lead to an expansion of the deficit and both will depend on the composition of congress to pass legislation.

In our view, at some point the deficit will matter (see below).

Within this context, rather than act prematurely, we have continued to watch the charts and inter-market relationships for our signals while understanding the policy backdrop and fundamentals that underpin the market moves

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

4. The US Debt Maturity Wall and Fiscal Dominance

Source: Strategas. Through year-to-date 2024.

The chart above shows the percent of US debt maturing by period over the next 20+ years.

In addition to the borrowing requirements to finance the deficit, the US government will need to refinance 54% of US debt currently outstanding over the next three years.

Currently, the US has nearly $36 trillion in debt outstanding.

This means that the US will need to borrow over $20 trillion over the next three years.

To put that in perspective, at the end of 2017, the US only had $20 trillion in debt outstanding.

Notably, the current weighted cost (yield) of the debt outstanding is 3.4%.

With the 2-Year US Treasury yield at 4.2% and the 10-Year US Treasury yield at 4.3%, borrowing costs will increase.

Interest expense as a portion of the overall US fiscal budget is likely going to continue to move higher.

As the market considers the scope of government debt outstanding and future borrowing needs, regardless of the Fed funds rate, yields could move higher. (This has been our view for the last six months).

In other words, bond markets - barring QE - will ignore the moves of the Fed. This is Fiscal Dominance.

Fiscal Dominance is going to impact the ability of the next president to enact policy and will also dictate monetary policy decisions.

This, in our view, could be a risk to equity markets.

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security and is not investment advice. Please do your own due diligence).

5. Europe: Failure to Launch

Source: Trading View. Through year-to-date 2024.

The chart above shows the Vanguard Europe ETF (ticker: VGK).

For the last 10 years, I have heard the pitch, mainly from large European banks, that European equities were historically cheap relative to the US equities and therefore, they are a “buy” or “overweight” vs. US equities.

Both the thesis and the conclusion has been consistently wrong (we have a piece coming out on this).

From August 5 to September 30, the Europe ETF rallied above its 2021 levels and found a new all-time.

However, since September 30, the ETF is down 7.5%.

Notably, in November 2021, the Europe ETF began to head south six weeks before the S&P 500.

Should we view the recent sell-off and failure to move meaningfully above the 2021 high as a warning sign for US equities?

At the very least, along with the inability of the Nasdaq 100 and Dow Industrials to meaningfully move above their respective 1.618 Fibonacci extension levels (chart 1), there is an increased risk of the S&P 500 of falling to, if not below, its 1.618 Fibonacci extension level at 5620.

(Past performance is not indicative of future results. This is not a recommendation to buy or sell any security, please do your own research).